Certainly not boasting. Simply stating the facts as they stand today. My company is one of the leading manufacturers of offshore and deepwater drilling equipment. Oil, like the economy, goes in cycles. There was a time when a gallon of gas was less than a

buck, there was also a time in America when there were lines around the corner for gas and it just couldn't be

had. So many people are stort sighted and do not remember that we have been here before, sad

part is, we did not fix it the first time thus we find ourselves there again.

The oil industry goes in phases where there is no drilling and then it goes into drilling phases when the powers that be realize the supply must catch up to demand...these cycles often last a decade. When the industry is in a drilling phase, obviously, my company does well, when there is a lack of new drilling, we hurt. Luckily my company also manufactures for other industries (yes, the US manufactures) so we are able to cope without the same lay-offs that other companies suffer. People complain about oil companies when the

price is high...they are happy when the

price is low, they do not take into consideration the people who

work for these companies and how we lose jobs in the lean times.

Nor do people realize the Herculean effort, the huge network of companies working together to put gas in their tanks, if they did, they would wonder why gas isn't more expensive. If there is inflation, it effects oil as well.

Oil companies need to meet the growing demand and are now tapping HUGE resources that have until now remain left untouched. Huge oil reserves off the coast of

China (Bo Hai) are being tapped now, these reserves are enormous as well as new reserves offshore in deepwater that have remained untapped because of the sheer logistical problems that are related to drilling in such deepwater. New technology that my company and others have developed are now opening these reserves to us.

People complain about oil company profits but they simply don't realize how it works, the amount that these companies must invest simply to tap a new well, especially in deepwater. These wells that

help remove us from opec. A company like, say, Shell oil must invest billions with the hopes that the wells they develop will make the investment worth it. They watch the oil COE's bank accounts and cry foul forgetting that EVERY CEO makes huge amounts of

money and that what a company like Shell Oil makes trickles down to the hundreds of companies it employs to Drill, manufacture, transport, service, etc...all around the world, not just american companies. It is truly a worldwide business.

They must spend, sometimes 10 years, developing the well, paying companies like mine to develop

tools for each well, most wells have unique requirements. They must pay us for our time, engineering expertise, the raw materials, the tooling. They must buy wellheads, liner hangers, trees (be they subsea or surface), gate valves, adjustment subs, mudline suspension equipment, tubing, connectors, control systems, safety systems, etc...etc...They must pay service companies, they must pay manufacturers, scouting, research.

Then they must spend the

money, often times a million dollars a day or more to operate a platform offshore, the logistics of transporting and refining. Lets not even mention what one must spend to placate the government and people to operate in many places. Before a well even draws a drop of oil an oil company heavy player is often out billions from their own pockets. Then they must get that oil to your gas tank at a reasonable

price (less than a gallon of water at times or a meal at McDonalds).

It is no wonder they often prefer to lean on those nations that already have the infrastructure and already accept our presence and doesn't have a population looking to kidnap the Americans (or western business

men be they from Scotland or Norway, both big players...americans are not the only target, just the favorite). My company operates in some of the most hostile places, in fact we operate in most oil producing nations from the

north sea to Nigeria.

Then of course much of the worlds oil is bought and sold on the open market, futures and such. These investors are only too happy to buy huge reserves and sit on them until they can create a crisis and hike prices even more before they release the reserves. These are, by far, not just Americans but investors from

Russia and all over the world. The

price going down is not acceptable to profiteers. Then of course you have to pay every middle

man...it reminds me of why coins are so expensive...middlemen...people just wanting to make that extra dollar.

Then of course lets not forget that more than half of the

price of a tank of gas is tax.

Buying from established producers isn't much better...the oil company buys each barrel at a set

price. Once the profiteers and middle

men have taken their cut all along the way, the

price is tripled.

There is enough oil to meet demand and there are new sources being found and tapped, the high prices are artificial, caused by politics and middlemen, when oil is a commodity traded like stocks, like stocks, the

price will never go down until there is a collapse.

As for the dollar and currency WORLD WIDE. The problems we

face are due to the fiat system and fractional banking. In the US this is the FED (which is made up of wealthy bankers from not just the US but

Germany,

Britain, and

China) and following the US lead, all the worlds economy is fiat. Artificially propped up 'because we say so.' Before modern fiat currency, the only time the world saw fiat was during emergencies such as the

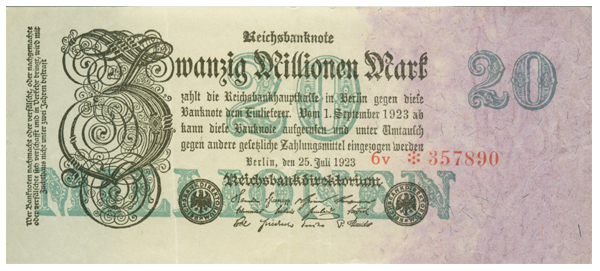

type seen during post WWI

Germany (I collect hyper inflation currency and study the causes)

If any nation believes that they are secure in such a system and that this will only effect the US they are sadly mistaken.

I believe the only way to cure the constant world wide inflation (and what might become the US hyperinflation) is to stabilize and control a world wide banking system which is out of control. It is not the amount of

money one makes but what the

money buys.

If people are wondering what fractional banking is, almost all of us have been a

part of it. It is when

banks are able to create

money without the government. When a bank gives a loan or issues credit, they are creating

money and releasing it into the economy. As we all know, the more

money created, the less that

money is worth in the long run until it is worth just a fraction of what it should be worth in a healthy economy. The incorrect way of addressing the problem is to release more

money (which is what the US is doing as fed

banks create digital

money outside the realm of congress) or making higher

denominations, both were tried in

Germany with disastrous effects and the US seems to be repeating this.

Germany had to suffer a disastrous collapse before their

money could be stabilized again with the rentenmark.

The US, for more than 50 years has been slowly feeding inflation with fiat FED junk

money and incompetent economic policy that allows a free for all

money creation scheme.

THINK ABOUT IT. At one time in America, you could by a meal for one silver dime, for a silver quarter you could buy a meal, a movie, and some drinks. Now that silver dime is worth far more than a dime, the value of that silver dime can

still buy a meal....but it takes far more junk bills to buy the same things. Silver and Gold

still has purchasing power that has remained roughly steady (or risen) save for the

Hunt brothers affair. This is why they dont want you to have silver and gold as

money, they instead keep it as a specialty, a commodity item they can sell to you, not as

money. By they I mean the FED and the few people at the

head of the worldwide

banks that control our economy...

That is why I keep a large amount of my

money in hard Gold and Silver. By doing this...I have made far more

money than I would investing in the stock market or gaining the pittance of interest

banks might give. In fact with gold prices...my gold is now worth far far more than it was when I bought it

I have a feeling that the US and world economic systems are beyond the comprehension of a lot of people and they do not realize that under the fiat system controlled by the fed our

money has been taken out of the

hands of the government are in the

hands of foreign and domestic

banks run by old

money, these peoples wealth is not dependant on the fiat

money and electronic junk created by their own

banks push on us. The 'I hate america and relish seeing them fall' mentality I see is politically motivated and will bite them in the rear, they are simply playing the game they have been taught to play. People all around the world who know do not hate america, they have helped america grow as they profit as well. Until we

wise up and break from the FED

banks and other nations that hold our debt and establish a true economic system again, we will continue to see inflation and soon might even see

denominations like the bill pictured below.

The only people in

Germany who survived with their

money in tact were those who escaped the fiat system and did not have their wealth in the Reichsbank. Unfortunately today, all the worlds economy operates on the fiat system and when a superpower stumbles, all the world will feel it in the end as there are few alternative to fiat today.

I have never

had a negative attitude towards the rest of the word, I have enjoyed traveling all through Europe,

Asia, South America,

Africa and the Middle East and have always

had a high opinion of the people I meet for the most

part. There has always been those Americans who are antagonistic towards the rest of the world, those are often people who just dont understand the world and are locked in their own little world where America is the greatest. I see the antagonism towards America from the other

side as the same small mindedness. I see the antagonism online, not

face to

face...they are not brave enough for that when I am in their country doing business that helps us both and those people I deal with are people who understand the world economy and profit from their relationship with america

. I have friends all over the world that do not take

joy in seeing America falter any more than I take

joy in the problems people

face in

Russia, eastern Europe,

Africa, or the like...its just stupidity and politics, the bane of the world IMO. I remember visiting

Rome and paying 50,000 Lira to rent a scooter!! Those who make

money realize that cooperation is the key in a worldwide economy and when one of us hurts, it hurts us all in the end.

Sorry so wordy